The Whitmore Group

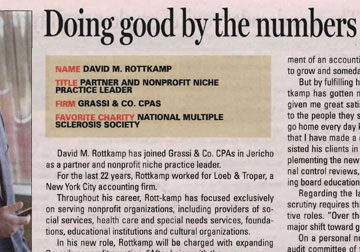

|

||

The Whitmore Group

Founded in 1989, The Whitmore Group, Ltd. has steadily built our business beyond insurance brokering. Each of our managers is vital to the operation and structure of The Whitmore Group. I invite you to review our website for information about the divisions of The Whitmore Group and our management team. Working together is something The Whitmore Group does exceptionally well.

About Whitmore

At The Whitmore Group, we understand the importance of providing insurance products that meet the needs and concerns of our clients as well as building relationships that stand the test of time. That is why, at The Whitmore Group, A Relationship Is A Partnership.

The Whitmore Group, Ltd. provides the gamut of insurance products and services such as Commercial Property and Casualty, our specialized Funeral Services Program, Personal Insurance, Health Benefits, Life Insurance and Estate Planning, Financial Services, Real Estate Insurance Programs, and Claim Services.

The Whitmore Group is committed to simplifying the insurance purchasing process for our clients while securing their coverage with only the finest insurance providers available. For these reasons, we encourage you to communicate your reaction. Your comments and thoughts are most welcome as we continue to serve you better. I can be reached directly at JMetzger@whitmoregroup.com.

Commercial Insurance

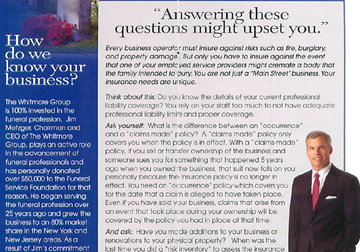

As a business owner, you understand the importance of protecting yourself against the exposures that exist while operating your company. The value of comprehensive Property and Casualty coverage that is tailored for your industry can make the difference between having coverage for a claim and having to pay for a costly loss out of your own pocket. Unfortunately, in most cases, it takes the reality of an uncovered loss for many company owners and managers to finally have an expert review their current insurance coverages. At Whitmore, we pride ourselves on offering solutions to the problems of business owners and these solutions lead to the creation of long-term relationships with our clients.

The Whitmore Group’s Commercial Insurance staff has coordinated the Property & Casualty insurance coverages for some of the most intricate industry classes. We understand the need to identify each of the exposures you face everyday and then review your current insurance coverages to ensure that you have proper protection. Following our review of your current insurance program, we will recommend a structure for your coverages that will benefit you – and your company – economically and efficiently.

Whitmore has a significant understanding of each insurance company’s underwriting appetite and we won’t waste time by approaching every insurance company just so we can tell you we did! Instead, we will identify the insurance companies best suited to provide coverage for your type of business and negotiate the most favorable pricing and terms on your behalf. Whitmore has extensive brokerage relationships with each of the nation’s most reputable and financially stable insurance carriers which affords us the ability to place your coverage with the most appropriate company.

Knowing that your assets are protected and that your coverage is provided by an insurance company that will be around to pay for claims will provide you with the peace of mind that enables you to focus on your business – not your insurance.

Whether you are a wholesaler, a financial or educational institution, a service operation or law firm, Whitmore can evaluate your current insurance program and propose a more comprehensive and more affordable insurance option without sacrificing coverage.

Real Estate Insurance

The Whitmore Group Real Estate Division has an experienced, professional account team to provide you with the service and expertise you deserve. We will complete an analysis of your current Property & Casualty coverages and design a comprehensive & competitively priced insurance program that provides coverage for all of your exposures. We will do periodic reviews of your account in order to identify any potential problem areas while confirming that the exposures on your policies are up to date. Additionally, we will re-market your account each year so that you are aware of new coverage enhancements and alternate programs that may have become available since your last renewal. We assist our clients and our clients’ attorneys in conducting reviews of leases and contracts. Following our review, we recommend suitable contractual wording that serves to limit our insured’s potential loss while transferring that responsibility to other parties.

Real Estate Insurance clients are offered a range of products and policies, including –

- Package policies

- Monoline Property and General Liability policies

- Boiler and Machinery

- Workers Compensation and Disability Benefits

- Automobile

- Umbrella Liability

- Directors and Officers Liability

- Commercial Crime

- Employment Practices Liability

- Lead Liability

- Pollution Liability and Mold

Real Estate Insurance clients include –

- Residential Condominium and Homeowner Associations

- Commercial Condominiums

- Cooperative Apartments

- Rental Apartment Buildings

- Office Buildings

- Shopping Centers

- Lessors Risk

- Industrial Properties

The Whitmore Group Real Estate Division’s client-centered approach to Real Estate insurance means a competitively priced Property & Casualty program without compromising coverage.

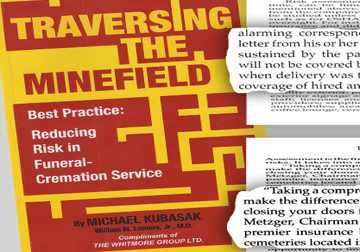

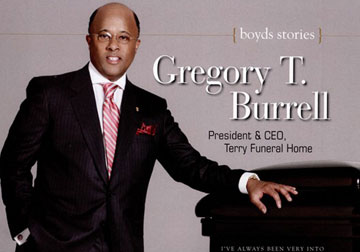

Funeral Services

The Whitmore Group, Ltd. understands the importance of providing insurance products that meet the needs and concerns of our clients, as well as the significance of building relationships that stand the test of time. It is for these reasons that we believe at The Whitmore Group, A Relationship Is a Partnership.

The Whitmore Group, Ltd. is a full service insurance agency specializing in the placement of insurance protection for the funeral industry. As a result of our focus and dedication to this area, The Whitmore Group has become the funeral industry’s largest provider of commercial property and casualty insurance which has earned us the trust of our clients. Our nationwide Funeral Services Insurance Program has emerged as “the choice” for the discerning death care professional.

It is no secret that today’s funeral industry practitioner demands expert knowledge, responsive service, and reliable protection from the world’s most financially secure insurance carriers. We, at The Whitmore Group, have developed a national insurance program that satisfies each of the above expectations while providing a customized solution and Whitmore’s commitment to help you achieve the goals you have established for your business.

Over the years, we have identified the specific exposures of the funeral industry and addressed these exposures with the proper insurance coverages. We have developed competitively priced insurance programs that meet the coverage requirements of our clients.

Please allow Laura Biviano, Vice President of Whitmore’s Funeral Services Insurance Division, to provide you with a risk assessment and comprehensive proposal. Laura can be reached at (888) 747-3343. We know you will agree that, at The Whitmore Group, A Relationship Is A Partnership.

Our Funeral Services include –

Property Coverage

Determining the correct type of property coverage is the sign of a qualified insurance professional. Whether you rent or own your own business offices, our account team can recommend the right policy for you.

Liability Coverage

- Premises Liability 1,000,000 / 2,000,000

- Directors and Officers Liability

- Professional Liability 1,000,000 / 2,000,000

- Employee Benefits Liability

Automobile

- Liability

- Medical Payments

- Uninsured / Underinsured Motorist

- Physical Damage to your automobile

- Personal Injury Protection

- Optional Coverages

Workers Compensation

Program Options:

- Traditional Guaranteed Cost Programs

- Deductable & Loss Sensitive Retention Plans

- Retrospective Rate Plans

- Self-Insurance Qualification Analysis

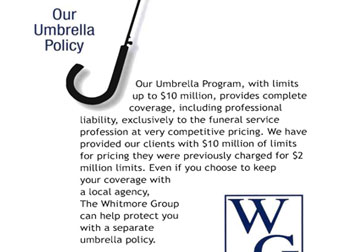

Umbrella Coverage

At Whitmore, we understand that your business is, perhaps, your most prized asset and the protection of this asset is of utmost importance to you and your family. When you purchase an Umbrella Liability policy, you will have liability limits and coverages that protect you in excess of the primary limits afforded by your General Liability, Professional Liability, Automobile Liability and Employers Liability polices.

Transportation Insurance Services

The Whitmore Group is one of the region’s leading brokerages specializing in limousine, bus and taxi insurance, offering a full range of transportation insurance products covering all of your transportation requirements.

Our many years of negotiating experience and market knowledge allows us the opportunity to obtain the best coverage available, at the best possible price, regardless of the situation. The Whitmore Group is best known in the industry for finding the best, most economical program that fits all programs, regardless of size, mix or history.

Whitmore’s transportation group only deals with the highest rated insurance companies, dedicated and established for the industry.

Our service is considered to be second to none, as our customers rely on us to handle all of their everyday activities related to insurance. Our in-house claims, MVR checks, instant insurance card issuing only scratches the surface to what we offer new, and existing clients. Once with Whitmore, you’ll never have to deal directly with the insurance company again, as our job is to be the advocate for the insured.

“Once with Whitmore, you are truly regarded as a family member, and will be treated as such” James C. Metzger – owner of The Whitmore Group. “We pride ourselves in treating your policy as if it’s ours, both in price, coverage and service”.

Whitmore’s Specialized Limousine and Bus Insurance Programs include:

- All of our programs include Automobile Liability, Physical Damage, Lot Coverage, EPLI, Liability and property Coverage

- One stop for all Group Life Insurance, Medical, Dental, Disability, and Prescription Drug Plans

- Safety plans, loss analysis, motor vehicle reports, are all services available through Whitmore

- Workers’ Compensation Insurance

Types of Operations:

- Charter Buses

- Sightseeing Buses

- Limousines

- Airport Buses

- Transit Buses

- School Buses

- Shuttle Vans

- Van Pools

Insurance Brokerage Services:

- Automobile Liability

- Physical Damage

- General Liability

- Workers’ Compensation

- Garage Liability

- Garagekeeper’s Legal Liability

- Excess/Umbrella Liability

- Property Coverage

Contact Joe Marotta - Whitmore Group Vice President Transportation Group (516) 639 6186 jmarotta@whitmoregroup.com. for more information

Personal Insurance

Risk is a fact of life both professionally and personally; however, risk can also be managed. With an experienced partner such as The Whitmore Group, we will assist you in assessing, reducing and planning for risk.

Since The Whitmore Group’s inception in 1989, we have understood that our business is much more that just the brokering of insurance. It is the management of relationships with our clients as well as understanding their personal insurance exposures. We understand the importance of identifying, controlling and transferring our clients’ risks to quality insurance companies.

Our Personal Insurance clients are informed of the various insurance policies available to them as well as the actual application of the coverages provided by each policy.

We offer a broad range of personal insurance products, including –

- Homeowner (dwelling, condominium, cooperative apartment, renters)

- Automobile

- Special Interest Automobile

- Watercraft

- Valuable Personal Possessions (jewelry, fine art, collectibles, etc.)

- Personal Umbrella

- Excess Personal Umbrella

- Flood

- Excess Flood

The Whitmore Group places significant emphasis on securing quality insurance coverage for you and your family. While we realize that cost is extremely important to you, we believe that the actual insurance contract and policy wording are of equal importance. In the long run, a well-structured personal insurance program will, more often than not, lead to lower costs to you while providing a broader scope of insurance coverage.

The Whitmore Group’s Personal Insurance Division consists of experienced insurance professionals who realize that our relationships with our clients are paramount. We will design and maintain up-to-date personal insurance programs for you in order to ensure that the full extent of your exposures are protected. We look forward to hearing from you.

Health Insurance

As a business owner or executive, you are well aware of the challenges that the health insurance arena presents.

The rising cost of group employee benefits, coupled with the increases demands on Human Resource services, present important challenges that must be met head on and with knowledge and expertise.

Our staff has extensive experience in designing benefit plans that best meet the needs of small business, as well as the complex structures of large, multi-site organizations.

We ask you to inquire about how our services can be a benefit to you.

- Access to all carriers

- Service Small Group plans

- Service Large Group plans, including self-insured groups on a nationwide basis

Group insurance products menu

- Medical

- Dental

- Vision

- Life & AD&D

- Long Term Disability

- Short Term Disability

- Voluntary Products

Experienced Staff

- Over 15 years experience in the group insurance industry.

- Our client service is our number one priority.

- Our responsibilities to our clients include, enrollment issues, billing questions, and plan design changes.

- We provide human resource administration support to your business.

- We remarket your program on an annual basis by showing you alternatives within your existing insurance carrier as well as other options that are available in the marketplace.

Financial, Life, & Estate Planning

The Whitmore Group’s Financial Services is dedicated to meeting the financial needs of our clients. We have the professional skills and experience that are necessary to tailor a financial plan that will protect, preserve and enhance your wealth.

Some of the vehicles utilized to achieve these results include –

- Life Insurance

- Disability Insurance

- Long-Term Care Insurance

- Investments

- Executive Benefits

- Buy-Sell Agreements

- Key Person Life

- Deferred Compensation

- Section 412i Plans

- Retirement plans

- Defined Benefit Plans

- Cash Balance Plan

- Annuity Plan

- Defined Contribution Plans

- Profit Sharing Plan

- Money Purchase Plan

- Simple Plans

- 401K Plans

- Stock Bonus Plans and Employee Stock Option Plans

- Defined Benefit Plans

The Whitmore Group’s Financial Services staff are licensed professions. We invest our time to learn about each client’s financial objectives, time horizon and risk tolerance. Our services include projected results, tax implications, and investment alternatives.

Claims Services

When you have an automobile accident or you are notified by a third-party that he was injured on your premises, you need to be confident that your claims representatives will not only provide a timely and accurate description of the incident to your insurance company, but also that they will pursue a resolution that is most beneficial to you. You need to be comfortable that your claims representative is monitoring each step of the claims settling process.

The Whitmore Group’s Claims Services Division prides itself on requesting the information pertinent to each claim and then reporting these details to ensure that your carrier will react quickly to protect your interests. Once your claim is assigned to the company’s adjustor, our claims representatives work together with that adjustor to arrive at a fair and justified conclusion.

Whether your claim is automobile-related or an alleged third-party injury, our Claims Services Division will advise you of the reporting process as well as work to facilitate your needs so that you can get back to more important matters – your business.

The Whitmore Group’s Claims Division provides the following services:

- We execute First reports from our clients.

- We report claims to insurance companies upon notification by our insured.

- Assist new clients in the event that they experience difficulties during “routine” settlements.

- Follow up with clients and insurance companies to ensure that all involved parties are in agreement regarding a fair and rapid settlement.

- Negotiate with carriers to determine the appropriate level of reserves that are set for Liability & Workers Compensation claims.

- Monitor third-party collision claims for insureds who are not responsible for accidents or for those insureds that do not have collision coverage.

We, at the Whitmore Group, are prepared to assist clients with respect to questions involving all types of coverage as well as how those coverages impact our clients’ claims.

Whitmore Advisory Group

The Whitmore Advisory Group, LLC (WAG) is a full service business development firm, dedicated to helping entrepreneurs reach their full potential. We specialize in assisting small to medium size businesses in these difficult economic times. WAG services include the following areas of expertise:

- MANAGEMENT AND SALES CONSULTING

- BUSINESS DEVELOPMENT/OPERATIONS REVIEW

- DIRECTOR / EXECUTIVE MANAGEMENT AND ADVISORY BOARD CONSULTING

- COMMERCIAL PRIVATE LENDING SERVICES

Management consulting services: Comprehensive Analysis of the business including, Cash Flow, Funding, Human Capital Management, Performance, Growth, and Succession Strategies.

Sales and Marketing development and implementation including: Sales and recruiting strategies; Sales incentive based pay structure creation; Assistance in screening, interviewing and hiring salespeople as a profit center rather than an expense.

BUSINESS DEVELOPMENT/OPERATIONS REVIEW

Perform an in depth unbiased review of: company history, organization, sales, expense control, policies, procedures, systems and financials. Make recommendations on strengths and weaknesses based on review to maximize profits. Profit engineering by developing and recommending incentives to key business drivers.

DIRECTOR / EXECUTIVE MANAGEMENT AND ADVISORY BOARD CONSULTING

Assisting management in reviewing organizational changes, analysis of existing business issues. Assisting in the development of strategic plans for improvement.

COMMERCIAL PRIVATE LENDING SERVICES

Our Commercial Private Lending Services include:

- We offer funds to borrowers in need of immediate capital.

- We can provide money in as little as 7 days.

- We lend against all property types including: multifamily, hotels, land, office, industrial, retail, single family and partnership interests.

- We can fund any type of transaction including: purchase, refinance, new construction, development, foreclosure, bankruptcy and others.

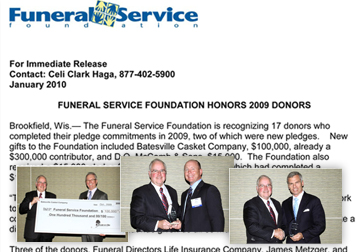

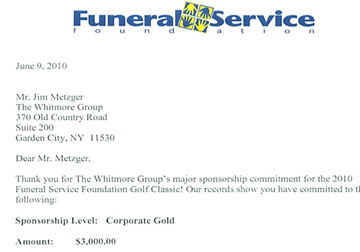

Industry Leadership - The Funeral Services Foundation

James Metzger is a member of the Board of Trustees of the Funeral Service Foundation. The Funeral Service Foundation is a national public grant making organization whose mission is, through charitable gifts and grants, to provide resources for Career and professional development, the support of funeral service and allied professions, public awareness and education, and the improvement of children’s lives. [more info]

Excerpted from Funeral Service Foundation Press Release

The Funeral Service Foundation (FSF) is proud to announce a major new gift from Jim Metzger of The Whitmore Group. The $50,000 gift , the second such gift from Metzger, will support the Foundation’s work to advance the funeral profession, and brings his overall commitment to FSF to $100,000.

“Jim Metzger’s continued major support of the Foundation demonstrates his commitment to helping move the funeral service profession forward,” FSF Chair Alan Creedy said. “Thanks to his ongoing generosity and leadership, we will be able to continue to support groundbreaking research and other grant opportunities to benefit funeral service.”

The gift was presented to the foundation by Jim Metzger, Chairman and CEO of The Whitmore Group, at the FSF Donor Reception, held during the 2010 NFDA International Convention & Expo in New Orleans, La.

“I gave to the Foundation because I believe so strongly in what funeral service does,” Metzger said. “I served on the board of the Foundation as a part of that commitment, and this second gift reaffirms my support of their work to support research, grants, and scholarships that make our profession stronger.”

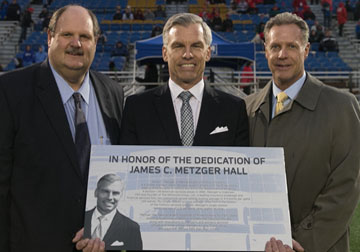

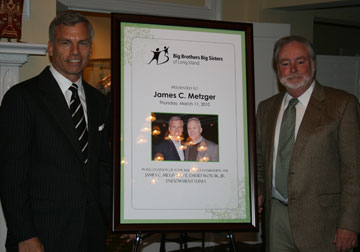

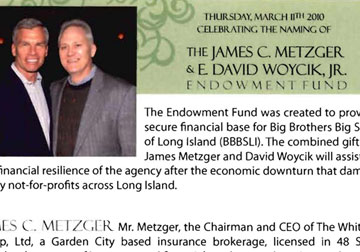

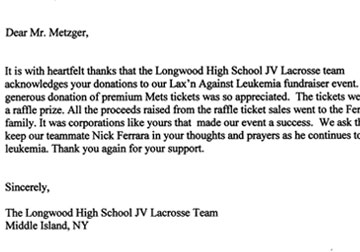

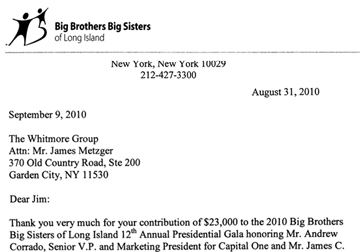

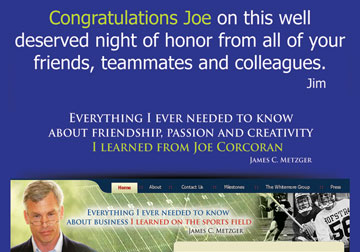

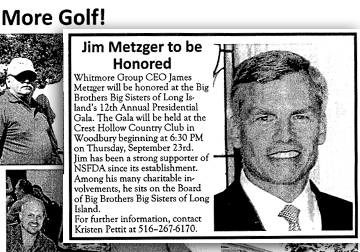

Community Leadership - Big Brothers Big Sisters of Long Island

James Metzger and The Whitmore Group are passionate supporters of Big Brothers Big Sisters of Long Island. Jim is a member of the BBBSLI Board of Directors. He, along with Dave Woycik, have pledged a gift to establish the James C. Metzger & E. David Woycik, Jr. Endowment Fund that will help ensure future financial stability for the organization. Jim and The Whitmore Group were Presidential Sponsors of the 12th Annual BBBSLI Annual Gala. Jim was recently honored as the 2010 Big Brothers Big Sisters of Long Island Man of the Year. The following is an excerpt from the Jim’s bio that was released by BBBSLI as part of the ceremony:

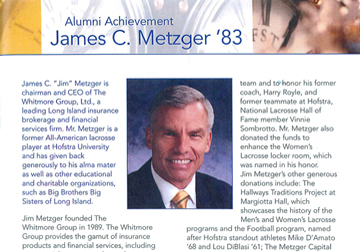

“James Metzger (Jim) is Chairman and CEO of the Whitmore Group, Ltd., a leading insurance brokerage on Long Island that he founded in 1989. He is also a prominent philanthropist on Long Island and a former star athlete.

Jim entered the insurance industry in 1983. He was fortunate to have the opportunity to work with two of the industries most prolific sales executives, Richard Ferrucci and Frank DeMartino. Jim went on to found his own award winning agency, The Whitmore Group, Ltd., in 1989.

The Whitmore Group now has more than 70 employees. They provide a full range of insurance products and services including Commercial Property and Casualty, a specialized Funeral Services Program, Personal Insurance, Health Benefits, Life Insurance, Estate Planning, Financial Services, Real Estate Insurance Programs and Claims Services. The company has received many industry awards. Some of their most notable accomplishments include the 1995 Travelers Insurance Award of Excellence as top performing agent in the United States, Chubb Insurance Group’s Cornerstone Elite Agency designation yearly for 2007-2010, Harleysville Insurance Northeast Agent of the Year for 2005, member of the Merchants Insurance Group Presidents Club 2009-2010 and the Ace Insurance Company’s Elite Network Agency designation.

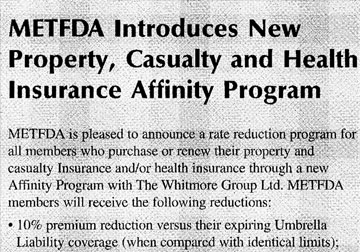

Early in his career, Jim identified the funeral industry as a business segment underserved by insurance. He worked diligently to develop specialized programs with a variety of insurance companies. The Whitmore Group offers competitively priced property and casualty coverage to funeral service professionals. It has grown to be the largest broker provider of commercial property and casualty insurance to the funeral industry nationwide. Among The Whitmore Group’s many association relationships, they are proud to be the endorsed Affinity Insurance provider for the Metropolitan Funeral Directors Association, the Connecticut State Funeral Directors Association, and the National Funeral Directors and Morticians Association.

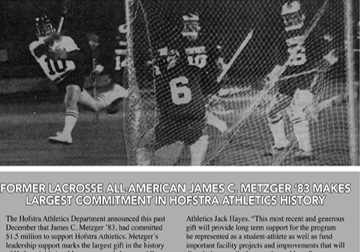

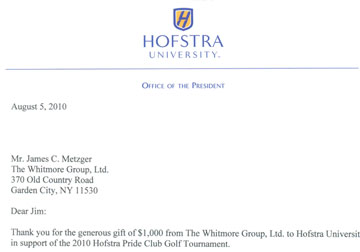

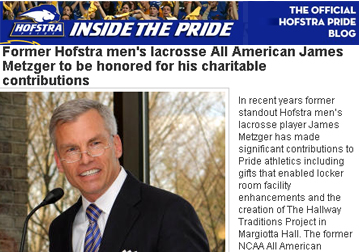

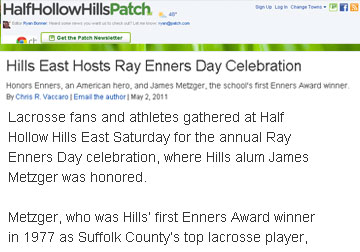

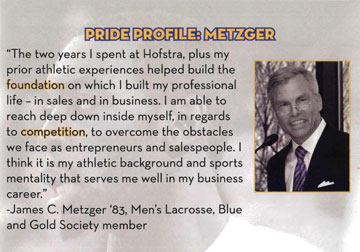

An alumnus of Hofstra University ’83 and Half Hollow Hills High School ‘77, Jim was an outstanding athlete who set records for both schools. He was a Suffolk County All-Star running back known for starting every game in his 3-year varsity football career. When he graduated in 1977, he was the school’s all-time leading scorer and rusher. As a sophomore, Jim played for the 1974-1975 HHH varsity basketball team when they were in the playoffs. As a lacrosse player, Jim was a high school All-American and a Suffolk County scoring champion. He won the Ray Enners Award as the outstanding lacrosse player in Suffolk County in 1977. In his senior year, Jim was the only athlete to be selected to play in both the North-South All-Star Football game and the North-South All-Star Lacrosse game. After high school, Jim attended the Naval Academy Preparatory School where he was the lacrosse teams leading scorer and Most Valuable Player. Jim played for the Hofstra University lacrosse team in 1979-80. He was named to the 1980 USILA Division 1 All-American team in his sophomore season. His scoring average of 4.9 points per game still stands as the Sophomore Record and ranks as fourth best in the history of the Hofstra lacrosse program.

Jim is appreciative of his success. Realizing that others are not as fortunate as he, he has reached out to help them through philanthropic gifts and service. In addition to sitting as a director on the Board of Trustees of the Funeral Service Foundation, Jim has also given them a considerable financial donation. The Funeral Service Foundation is an organization that supports funeral service and allied professionals through public grants and charitable contributions. Its mission is to provide resources for funeral service career and professional development, increase public awareness and education, support grief and bereavement services, and improve children’s lives.

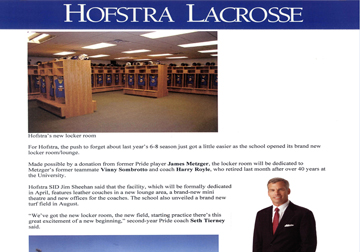

Metzger has been extremely supportive of his alma mater Hofstra University. In recognition of the time he spent playing lacrosse for Hofstra, he donated funds to build the Royle-Sombrotto Men’s Locker Room and the James C. Metzger Women’s Locker Room. He also provided funding for the DiBlasi-D’Amato Hallways Tradition Project celebrating the history of the men’s and women’s lacrosse and football programs. Jim serves on the Hofstra University Pride Club Board and is a member of their Blue and Gold Society. In addition to his generous funding of building projects, he has also honored former teammate Gary Arnold, former coach and Hofstra legend Kevin Huff, and the Unterstein family - Chris, Kevin and Mike. Plus, he has supported academics at Hofstra by recently funding a summer internship within the Center for Civic Engagement in honor of History Professor Michael D’Innocenzo. Hofstra University recently acknowledged Jim’s overall contributions by naming the James C. Metzger-Kevin Huff Lacrosse Offices after him.Jim and fellow Big Brothers Big Sisters (BBBS) of Long Island Board Member, E. David Woycik have set up The James C. Metzger and E. David Woycik Endowment Fund through the single largest contribution in the history of BBBS of Long Island. The fund will ensure that the BBBS of Long Island will continue its mission to help provide adult mentors for children at risk despite the economic downturn that damaged many Long Island non-profits.”

Community Leadership – Arthritis Foundation of Long Island

James Metzger and The Whitmore Group are long time supporters of the Arthritis Foundation. Jim was the 2014 Honoree at their Annual Salute Your Staff Luncheon & Auction.

Barry Landers of Landers Sports Productions gave the following introduction at the ceremony:

“Linda, thank you so much.

As someone who has suffered with psoriatic arthritis for most of my adult life I know first-hand about the effects arthritis can have on someone’s life. That is why I am truly honored to lend my support to the Arthritis Foundation and honored to introduce my friend Jim Metzger.

I met Jim about six years ago when I asked him to sponsor our high school telecasts of lacrosse games on Telecare. He didn’t hesitate - giving hundreds, if not thousands, of boys and girls their moment in the sun and a chance to play on TV.

Our passion for lacrosse, our love of family (and for sure our love of talking) cemented our friendship over the years. Jim is like the younger brother I never had.

You see Jim is a unique individual. Blessed with great athletic ability, he starred in basketball, football and lacrosse at nearby Half Hollow Hills East High School where he won the prestigious Ray Enners award as the best lacrosse player in Suffolk County.

Jim went onto Hofstra where he was an All-American lacrosse player in his sophomore year. Then he gave up lacrosse and concentrated on his studies. And in the late 1980’s Jim established The Whitmore Group which has become one of the largest independent insurance companies in the tri-state area with more than 75 employees, many of whom are here today.

You see Jim is a charismatic figure. He is like a pied piper. Family, friends and employees will follow him anywhere. Jim’s ability to lead reverts back to his days as an athlete. In basketball and lacrosse Jim was the play maker - sizing up the situation, making the right pass - the right decision - that lead to his teammates scoring and his team winning. You see Jim had the innate ability to see the play unfolding before it did. And he’s taken that ability, his competitive desire to succeed and his compassion and concern for those around him in his company, his family and in the long island community, to make him a truly outstanding person - worthy of this honor.

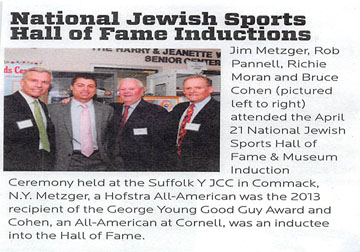

Jim has been honored by Big Brothers and Big Sisters, The American Heart Association, his alma mater Hofstra University - just to name a few. And next month Jim will be honored by the Suffolk Sports Hall of Fame for both his athletic career and his commitment to the Long Island community. Last year he received the prestigious George Young Award from the National Jewish Sports Hall of Fame, joining the likes of Lou Carnaseca, Bobby Nystrom and Wellington Mara as former recipients.

Jim is one of the most generous people I have met in my lifetime. His generosity has extended to Hofstra where he donated a million and a half dollars to their athletic program, to his alma mater Half Hollow Hills East High School where he established a scholarship to outstanding scholar athletes, and to many local non-profit organizations working with youngsters.

But perhaps the best measure of a man is how he treats those who work with and for him. I have seen this first hand. You see to Jim each one of his 75 employees is special. Whether it’s mentoring a recently graduated college kid interning at the Whitmore Group or schmoozing with amazing 98 year old insurance broker Richard Spear, watching Jim interacting with them is something to behold.

Jim’s staff is first rate, and I would be remiss if I did not mention Kristin Petit his gal Friday - best assistant you could ever ask for - who has also worked diligently on the luncheon committee.

When it comes to family - Jim’s mom Patricia and his dad Conrad, his sisters Susan and Tricia, and his nieces and nephews, Rob, James, Janice, Paul, Mark and Julia - you could not ask for a better son, a better brother and better uncle than Jim.

So there you have it - a man who has not forgotten his roots, who shares his success with family, friends, employees and the Long Island community he is so proud to be a part of.

It is my pleasure now to introduce your 2014 honoree - my friend - Jim Metzger”

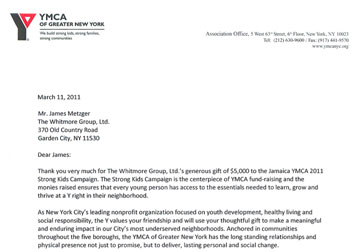

Arthritis Foundation Regional Director thanks James Metzger for $10,000 donation.

|

||

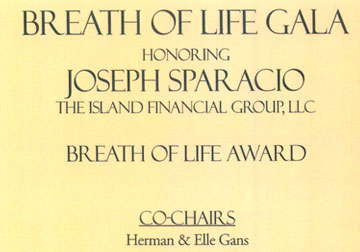

Players in the Picture

Players in the Picture